An effective competitive intelligence monitoring process is the fuel to keep your competitive intelligence program running on all cylinders, but with all of the information out there, it can also be the bain of your existence. So, is it time to implement a competitive intelligence solution?

As you start to look into 2023 and consider your intelligence process, it can be helpful to audit your current monitoring capabilities and explore procedural or infrastructure improvements for the new year. In this guide, we will share best practices for identifying the optimal information sources, filtering these sources to eliminate noise, and which technology to use to assist in your information analysis process.

What is competitive intelligence monitoring?

Competitive intelligence (CI) monitoring is the process of gathering information about your competitors to gain insights into their strategies and activities. CI monitoring aims to help you understand your competitive landscape so that you can make more informed decisions about your own business.

How do I gather competitive intelligence?

There are a number of different ways to gather competitive intelligence, including online and offline sources. Here are the top 10 sources we recommend you start with:

1. Company websites (Press release pages, blog pages, career pages, product landing pages)

2. Industry trade associations

3. Online news articles

4. Social media

5. Financial reports

6. Analyst reports

7. Investor presentations

8. Government databases

9. Job Sites

10. Internal intelligence contributions from customer-facing roles (sales, partnerships, business development etc.)

Check out our blog about key CI data sources you should be tracking here.

What is the best methodology for setting up competitive intelligence monitoring?

Information is prolific and can become overwhelming. We always suggest you ask yourself, what do your stakeholders need? (If you don't know, ask them!) For example, sales may need insights to help them win more deals. In this scenario, you would want to set up monitoring of competitors' product pages, pricing pages, a feed from Salesforce to perform win/loss analysis, and even a folder for other salespeople to contribute things they have heard on sales calls.

But, if your stakeholder group is the executive team, they are likely interested in more strategic information. In this case, we would suggest you set up monitoring of critical competitor alerts, funding alerts, financial reports, and analyst reports referencing competitors in your key product areas. The point is, the information you want to monitor is highly dependent upon the deliverables you intend to produce for your audience. So, start with your stakeholders' needs and map back to sources that will give you the answers you need to solve their problems. You can always start small and expand your source library with time. In our experience, it is way easier to expand sources than to try to cut down on sources after the fact.

How do I filter out the noise?

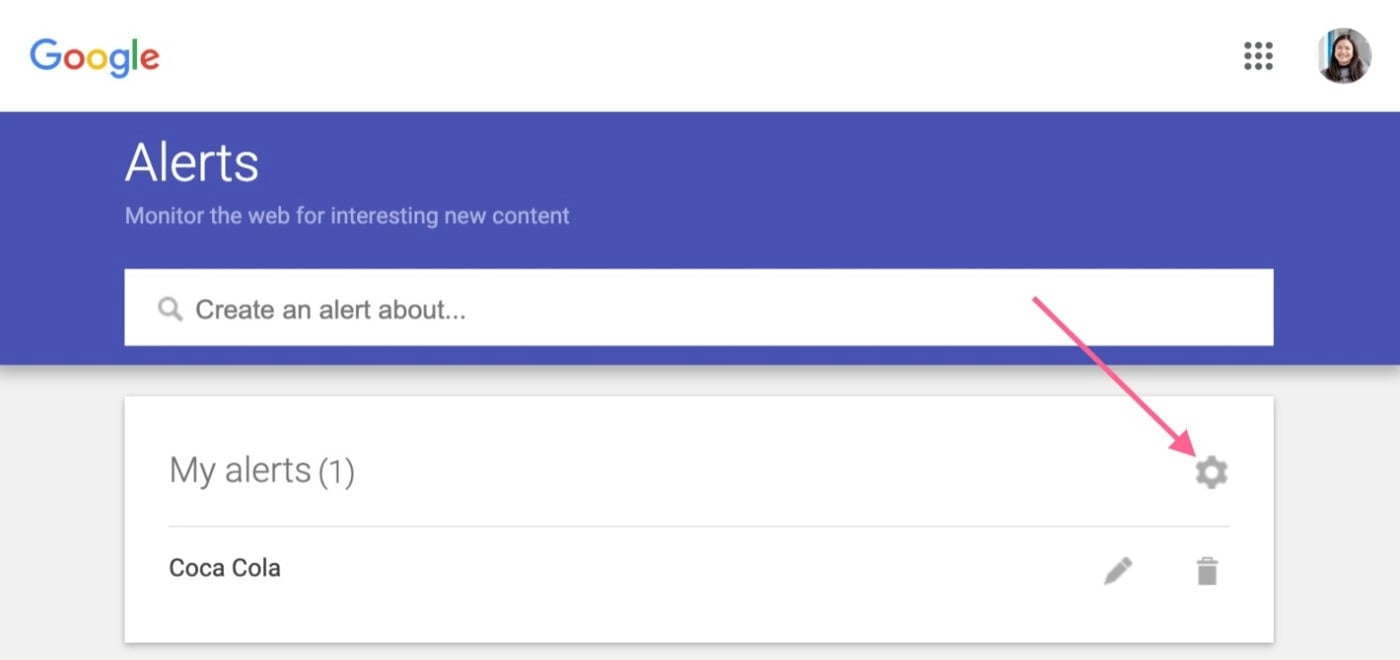

This is where technology really comes in. There are a number of free or cheap monitoring tools, that allow you to set up news feeds for example (i.e. Google Alerts). But, these are noisy as heck! So, we recommend you bucket your information sources based on topic, product area, or key competitors. In Wide Narrow, we call this an inbox. Once your sources are connected, you can use our InfoLab data processing module, to apply powerful positive and negative filters using keywords, your taxonomy, and even AI-recommended filters. You will be amazed at how much noise is filtered out. This is what we call pre-filtering and will ensure you have a manageable information flow from day 1.

But, wouldn't it be better if your filters could improve over time? Again, this is the difference between setting up free information feeds versus using a dedicated competitive intelligence monitoring tool. Not to beat the Wide Narrow drum too much 😊, but our platform provides you with analytics to review your inbox quality and tools to improve your inboxes across time. If you have ever set up 10 Google alerts and sent them into Outlook you will understand what a headache this solves.

What are the best competitive intelligence tools?

Selecting a competitive intelligence monitoring tool is very dependent upon your needs. To help with your research process, I am going to bucket the tools into 3 major categories (Free, Cheap, and Enterprise):

Free:

- Google Alerts: These are entirely free to set up and have some of the more popular public news sites. But man is it noisy. This is a great option if you have no other choice, but you will outgrow this solution pretty quickly.

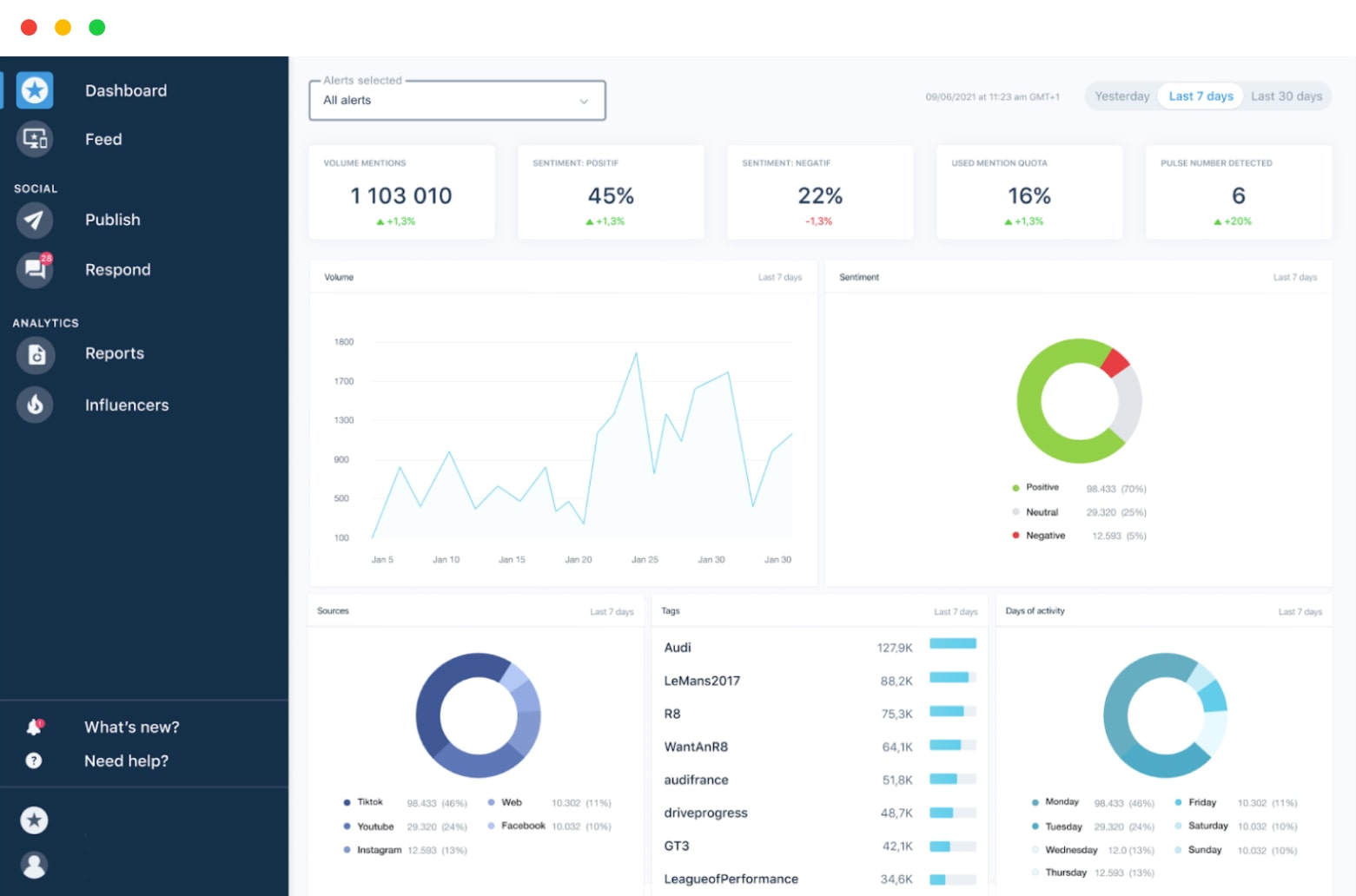

- Talkwalker: This site has a generous free account, letting you monitor a number of your competitors' social accounts. The number of social posts it monitors on the free plan is limited, but this is a good option if you are just getting started with social monitoring.

- Newsletters from government sites and industry publications: This is a great source of information and we highly recommend subscribing to the relevant sites. They aren't particularly noisy and the information is valuable. Although the information is coming in via newsletter, so you will likely be doing a lot of clicking, copying, and pasting. Again, a great start, but quite manual.

- Slideshare: Although a bit noisy, you would not believe the private information competitors will accidentally post to Slideshare. Their interface requires you to be a bit creative with how you find these PowerPoint decks, but it is worth a look to see if you can find a hidden competitive gem.

Cheap:

- SEM Rush: Although it started out as an SEO tool, SEM rush has expanded into monitoring competitors' digital ads. The competition in this space is hot so there are plenty of options, but this is the best we have found for the price.

- Mention: If you are looking to take your social monitoring game to the next level, Mention is a solid choice. With a much higher data limit and an analytics dashboard, you can get the gist of your competitors' social presence. Mention is useful right out of the box but does not have a way to feed insights out of the platform, so think of this more like a niche research tool.

- Analyst reports: Some may scoff at the inclusion of this under the cheap section of competitive intelligence monitoring tools, but let me explain. Analyst reports aren't particularly cheap per se, as they can cost anywhere between $1500-$15,000. But if you are interested in information related to a hyper-specific niche, such as an analysis of general-purpose robotics startups in the quick service restaurant industry, an analyst report can be immeasurably valuable and comparatively cheap to you performing that research yourself or hiring a firm to do it.

Enterprise:

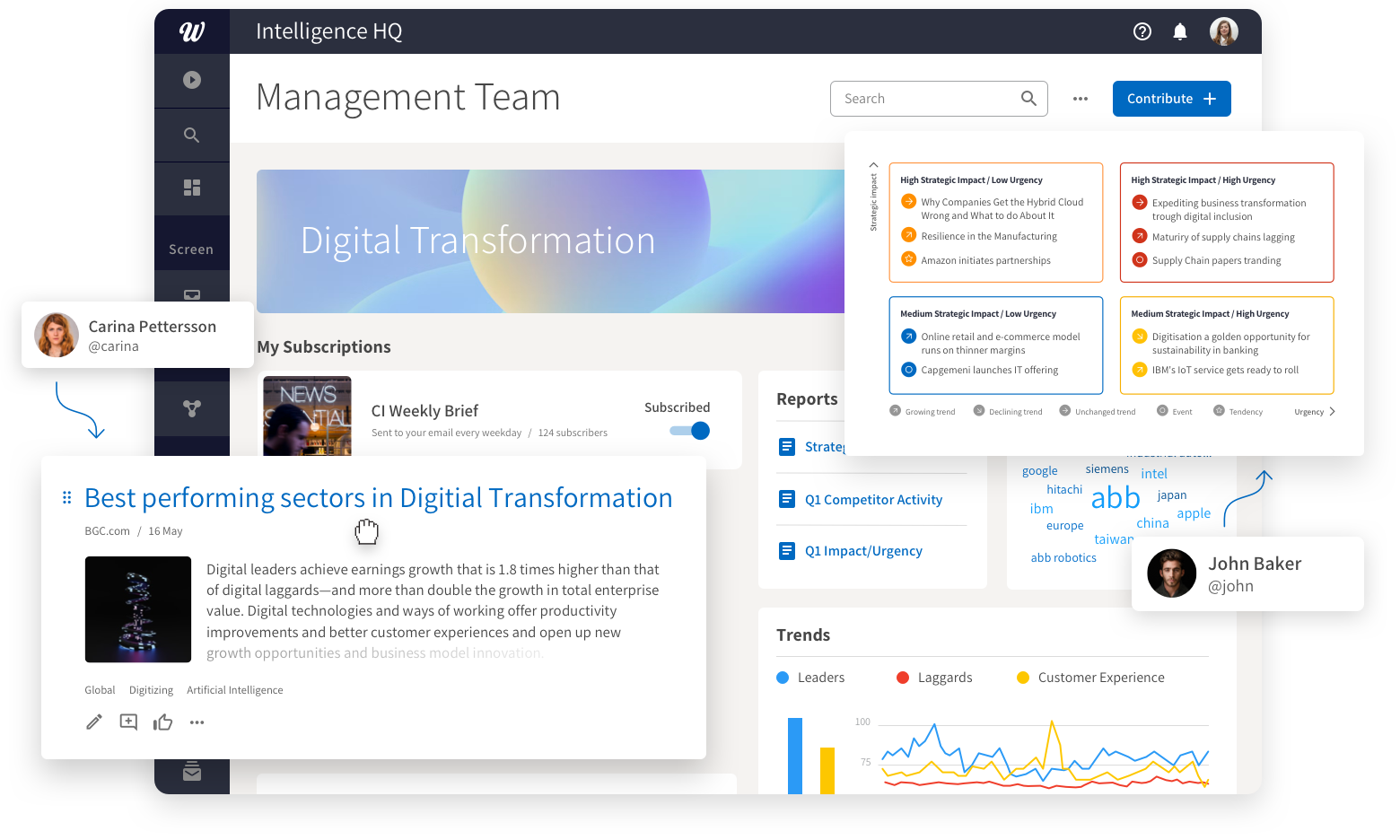

- Wide Narrow: Of course, we had to mention ourselves here 😉 But, the truth is, we have spent the last 10+ years improving our platform to be THE intelligence hub for companies worldwide. In our platform, intelligence professionals can monitor all of the information sources mentioned above, apply powerful filters, produce insights in collaboration with their colleagues, and produce stunning intelligence deliverables to be shared with stakeholders in a click.

- Alphasense: This organization has built a fantastic tool for collecting public company financial reports and layering some AI analysis onto the reports. This is their core focus and they are good at it. So good that we have a number of customers that connect Alphasense to Wide Narrow instead of feeding raw financial reports into our platform.

So what is my next step?

If you are starting a new competitive intelligence function, take some time and talk to your colleagues. Get the inside scoop on their perspective of the competitive landscape, and which competitors they see most, and develop a game plan to best serve your key stakeholders. Remember, Rome was not built in a day, so start simple and start small with the idea to scale your monitoring and intelligence deliverables as time progresses. When you have made the rounds in that first week or two, or if you are managing your competitive intelligence program with legacy infrastructure, it would be best to get a core toolset in place.

This is where Wide Narrow comes in. We are not just an intelligence monitoring tool, but an Intelligence HQ for your team. Having one place to monitor information, work on scheduled and ad-hoc projects, and produce deliverables rapidly with the help of a structured CI process can allow you to scale your efforts and provide exponential value internally. If you'd like to take that next step, please feel free to click here and schedule a live demo. It is never too early to consider leveling up your intelligence infrastructure.

COMMENTS